The West uses the weapon of freezing financial assets as part of its strategy to preserve its interests, and this is what happened with Libya since 2011, and it is repeated with Russia as well. Can countries recover these looted funds?

The Libyan experience in recovering its financial assets shows that this procedure is not separate from the operations of “colonial looting”, but it is carried out according to special procedures that attempt to legitimize it. The claim that these funds are kept in reliable and safe places and in approved countries is not true, in addition to the fact that their value decreases year after year due to several factors, including corruption, poor management, and overlapping international interests.

This pattern of Western dealing with state funds is primarily subject to the nature of European and American policies in pressuring to implement their agendas. In the Libyan case, there are real concerns about the fate of these assets in the absence of effective mechanisms to fully recover them. As for the Russian case, there is a violation of all international standards with some statements by officials in NATO countries about using these funds to finance the Ukrainian war.

Frozen Libyan assets

Several Western countries hold Libyan assets estimated at hundreds of billions of dollars, some of which are expected to reach $500 billion, which were frozen under UN resolutions 1970 and 1973, which were adopted by the Security Council in 2011.

The Libyan assets included bank deposits, real estate, and various investments, but journalistic investigations and judicial sources revealed multiple violations of the UN freezing rules, as some of these assets were released and used illegally. According to the Belgian newspaper “Le Soir”, $2.3 billion of Libyan funds in Belgium were unfrozen, and about $800 million of them went to a mysterious party.

A report in the “Libyan Express” newspaper revealed that Belgium violated sanctions by allowing the transfer of interest from frozen assets to accounts managed by the Libyan Investment Authority (LIA), which is surrounded by multiple corruption allegations, particularly in settling financial disputes, as it did in 2017 when it agreed with the French bank Société Générale to pay £815 million to settle a long-running legal dispute with the Libyan Investment Authority, related to fraud and corruption in transactions that took place between 2007 and 2009.

In 2014, the institution removed Palladyne from managing its assets due to concerns about mismanagement of funds, leading to multiple legal disputes in international courts, and there are other cases related to bribery and financial fraud, including lawsuits against international financial firms such as Goldman Sachs and Tradition.

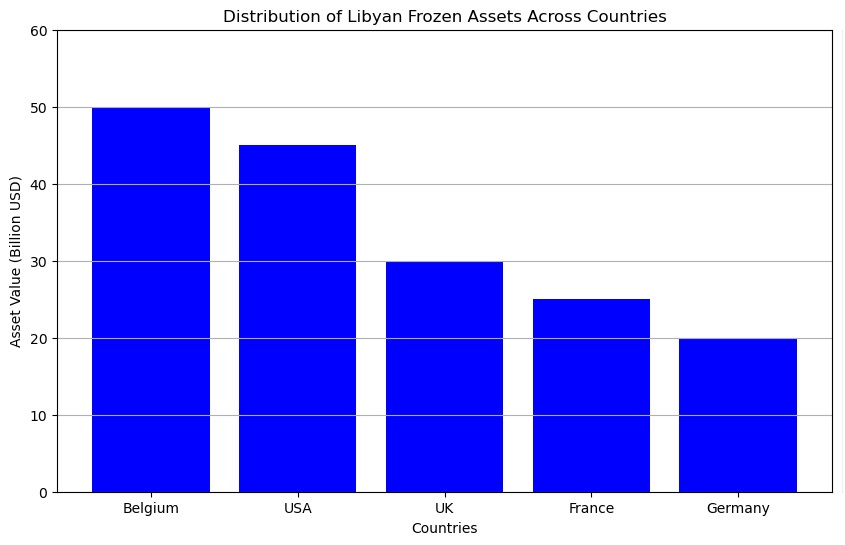

But Libyan assets are not limited to Belgium only, they are distributed among several countries, raising increasing concerns about their loss or misplacement. The following chart shows the distribution of assets by country and their value in each country:

Challenges of asset recovery

After more than a decade and a half of Western measures towards Libya, the challenges of asset recovery are becoming more difficult, primarily due to the challenges imposed by the political division that makes it difficult to seek international bodies to recover assets.

The Libyan government has sought to recover frozen assets through negotiations with the countries that hold these assets, and several committees and lawyers have been formed to carry out this task, including the “Libyan Money and Assets Recovery Office” affiliated with the Libyan Prime Minister’s Office, which has been entrusted with this task, along with following up on the return of these funds and imposing strict control over how they are spent.

However, the internal Libyan situation leads to weak coordination and a loss of international confidence, and widespread corruption in Libyan institutions supports the issue of mistrust, especially with the absence of effective international legal mechanisms to ensure the recovery of frozen assets, at a time when international interests play a role in creating difficulties in tracking and recovering assets.

The diversity of frozen assets, which include cash, real estate, stocks and bonds, and the multiplicity of parties that control them, including foreign governments, financial institutions and private companies, makes the issue of tracking and recovering them a complex matter, in addition to the different legislation and laws in each country that complicate the process of dealing with this issue.

But the most important issue is the way the countries that froze Libyan accounts dealt with it, as investigations in Belgium at least revealed disturbing details about the management of frozen Libyan assets, and a large part of them were unfrozen without taking into account international rules, which led to the loss of hundreds of millions of dollars. The following chart shows the violations that occurred with the rights of Libyan assets:

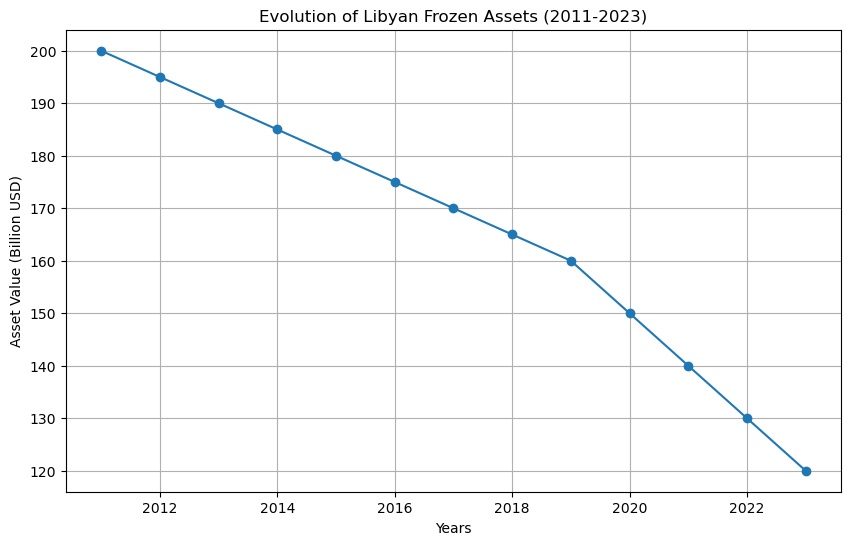

It is clear that violations have increased over a decade. In 2011, there were few cases of violations, but they increased significantly to reach 18 cases in 2023. The weakness of international oversight mechanisms in implementing freezing rules, increasing corruption and political tensions led to weak compliance with international laws. On the other hand, there was a continuous decrease in the value of frozen Libyan assets from 2011 to 2023. At the beginning of the crisis in 2011, it was estimated at more than 200 billion US dollars, but this value gradually decreased to reach about 120 billion dollars in 2023, as shown in the following graph:

This image of Western measures against Libya is being repeated with Russia, and this situation raises questions about the guarantees of protecting these assets from theft or illegal use, especially since some countries have threatened to confiscate these assets, and if the measures against Libya were taken within the Security Council, what is happening against Russia is happening unilaterally, which makes Russian assets more vulnerable to looting and fraud.

The issue of frozen assets cannot be viewed outside the framework of the systematic European and American looting of countries, as the efforts made to recover these assets remain subject to the political conditions of those countries and not to Libyan needs, and corruption and political division in Libya help the West control this file.

On the other hand, it raises major questions about the international economic system that today allows the freezing of Russian assets so that their fate becomes unknown in light of the lack of protection, as these measures are a result that did not guarantee international stability, but rather perhaps on the contrary contributed to the impoverishment of countries, and to increasing tensions, especially since the freezing of assets often occurs through sanctions imposed outside the United Nations, as happened with Russia, as part of Western policies to ensure their international influence

Written by Nidal Al-Khedary

A 77-year-old Russian woman marries a groom ten years older than her