The “Independent’s” report on the possibility of the collapse of the Libyan economy opened widespread controversy. Despite the response of the Libyan Ministry of Foreign Affairs, questions are still open about the nature of the numbers mentioned in the report.

The main point that cannot be ignored is that Libya is facing intertwined political and security times, and this matter will certainly be reflected in economic performance. Before starting to discuss the numbers, it is necessary to look at the existing reality, whether in terms of the presence of two governments, or even the nature of the differences within the outgoing national unity government. The state, especially the problems that arose between the governor of the Central Bank of Libya, Al-Siddiq Omar Al-Kabir, and Abdel Hamid Al-Dbeibeh, or even the conflict within the Ministry of Oil with the presence of two ministers, Mohamed Aoun and Khalifa Abdel-Sadiq, this matter indicates not only a crisis, but also clear corruption and manipulation operations in… The most important resources that Libya possesses.

The “Independent” newspaper report

When dealing with a report in a newspaper that has “prestige”, at least at the level of credibility, it is necessary to look at the nature of its coverage of any topic so that the data it presents does not become an attack. What the “Independent” newspaper presented adopts a different methodology from international financial institutions, as it is based on sources. Various, such as government statements, interviews with local experts, news reports, and press reports, to focus on negative points not only to attract readers, but also to link events and attempt to read crises primarily through their political aspects.

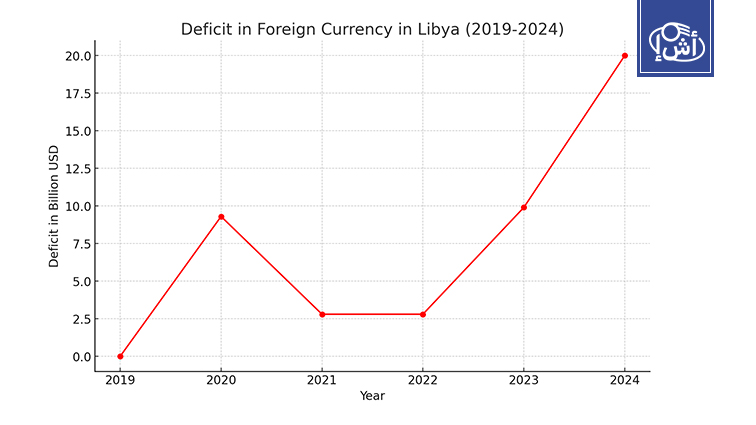

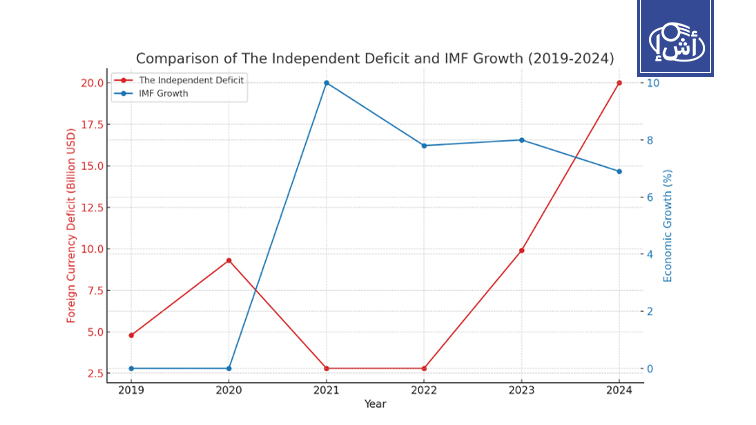

In practice, the differences in analytical approach, objectives and sources between the “Independent” report and major financial institutions; It creates discrepancies that do not mean in the end that press reports are misreading the data, but rather it presents a new angle for reading. The Independent report “reported a foreign exchange deficit in Libya during the past four years that exceeded 22 billion dollars, which forced the Central Bank to use its reserves to cover this deficit and threatened Depletion. The newspaper expected the deficit to reach approximately $20 billion by the end of this year, noting that the political division and economic challenges increase the fragility of the economic situation. The graph shows the numbers as presented by the “Independent” report:

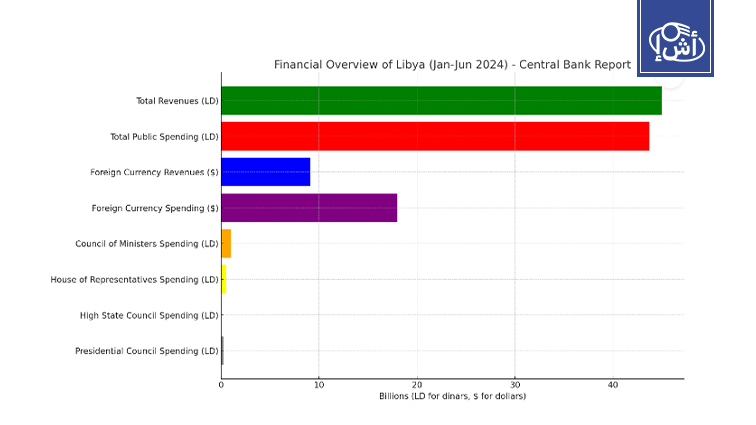

In a preliminary comparison with the report of the Central Bank of Libya, which covered the period from January to June 2024, the expectations appear to be close, as the bank states that total national revenues amounted to 45 billion Libyan dinars (equivalent to 7.3 billion US dollars), while public spending amounted to 43.7 billion dinars. ($6.9 billion), and the data showed an expansion of the foreign exchange deficit, which reached $9 billion, as revenues from foreign exchange amounted to $9.1 billion, while foreign uses jumped to $18 billion.

The report indicates that oil revenues amounted to 37 billion dinars ($6 billion), which is less than expected due to fluctuations in oil prices at the global level. The report shed light on the large spending of parallel institutions, as the spending of the Council of Ministers in the “National Unity” government exceeded one billion dinars. ($162 million), while the spending of the House of Representatives and its affiliated bodies recorded 496 million dinars ($80 million), the Supreme Council of State spent 21 million dinars ($3.4 million), and the Presidential Council and its affiliated bodies spent 230 million dinars ($37 million).

The data of the Central Bank and what was reported by “The Independent” newspaper are generally consistent, and this gives a consistent picture of the current economic situation in Libya, and there are some main points where information from both sources intersect:

- Foreign exchange deficit: Both sources indicate a large foreign exchange deficit amounting to billions of dollars.

- Revenues and Expenditures: Both reports address revenues and expenditures during the mentioned period, emphasizing that spending is approaching the level of revenues, and leading to financial pressures.

- Economic Impacts of Political Crises and Corruption: Both reports mention how corruption and political crises negatively affect the economy, focusing on how these factors affect the stability and development of the Libyan economy.

- Oil revenues: Oil revenues are pivotal to the Libyan economy, and both sources indicate that there are challenges due to fluctuating oil prices.

What the International Monetary Fund proposes

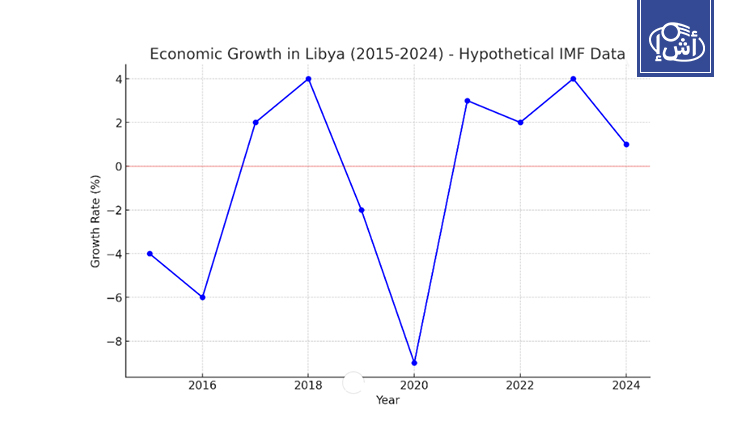

The Libyan response issued by the outgoing Government of National Unity relied primarily on what was provided by the International Monetary Fund, as the Fund’s information emphasizes the need for a clear and sustainable economic vision, and it expects economic growth of 8% in 2024. The Fund did not mention the same figures related to the deficit, but rather emphasized The importance of improving the financial framework to increase the ability of the Libyan economy to withstand shocks, and the following chart shows growth expectations according to the International Monetary Fund:

The International Monetary Fund indicated that oil revenues in 2023 amounted to $25.4 billion, with expectations of an increase in oil production to 1.5 million barrels per day by 2026. At a time when the “Independent” newspaper report was pessimistic about the continued deficit in light of the decline and fluctuation of oil prices, The International Monetary Fund appeared neutral and considered that Libya has the potential to achieve sustainable economic growth if it can manage its resources better. The Fund expected oil production to reach 1.5 million barrels per day by 2026, which would contribute to supporting the expected economic growth of 8% in 2024.

The reports show a significant discrepancy between the “Independent” and the International Monetary Fund’s assessment of the Libyan economic situation. While the “Independent” focuses on the large deficit and political corruption, the International Monetary Fund emphasizes the potential for economic growth and calls for a sustainable economic vision and financial reforms. The following two graphs illustrate the difference. Between the Independent and the International Monetary Fund:

The difference in numbers in itself explains the nature and depth of the Libyan crisis. The International Monetary Fund relies on official data issued mainly by Libyan institutions that are experiencing a real crisis. It is important to emphasize that the Libyan economy, no matter how different the numbers are, cannot show recovery in light of the existing conflicts within the economic institutions. In Libya, the differences within the National Unity Government have come into focus, and the lack of liquidity that has appeared on several occasions cannot be overlooked. Not only the Libyan economy is in danger, but also Libya as a whole if the political process does not reach radical solutions.

Written by Mazen Bilal

Launch of the international conference in Benghazi to enhance the role of projects in confronting unemployment